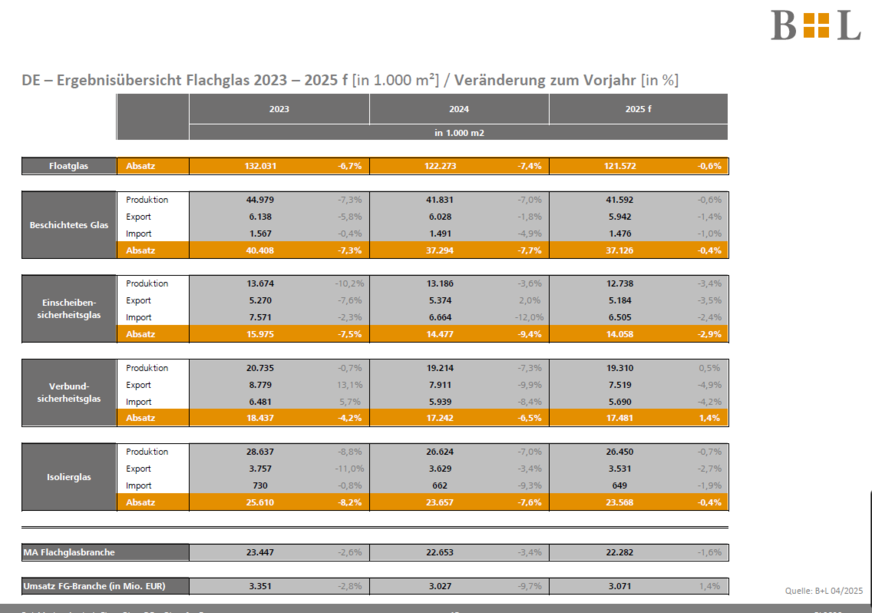

The German Flat Glass Association (BF) and the Window + Facade Association (VFF) jointly presented the current market figures for 2024. The data presented below provides an overview of the development of the individual glass segments in the domestic market.

In 2024, the flat glass market in Germany will show an overall decline compared to the previous year 2023. All important product segments will record noticeable reductions.

B+L Marktdaten

Sales of float glass fell by 7.4%, while coated glass recorded a decline of 7.7%.

The decline in sales is particularly pronounced in single-pane safety glass (ESG), which fell by 9.4%.

Laminated safety glass (LSG) also recorded a negative trend, falling by 6.5%.

Insulating glass, a key product in the construction sector, is also well below the previous year's level with a 7.5% decline in sales.

Despite these developments, the German Flat Glass Association sees initial signs of stabilisation.

According to the BF, the worst is now over. Although the market environment remains challenging, there are cautious signs of recovery.

There is hope for a gradual improvement in the market situation, particularly with regard to long-term investments, energy-efficient renovations and politically initiated measures to stimulate the construction industry. The association is therefore cautiously optimistic about the coming months.

Nevertheless, there is a downward trend in the availability of basic glass. GW News asked BF Managing Director Jochen Grönegräs for details.

Will glass supplies become more difficult?

GW News: The market figures presented at the Statistics and Market Symposium point to a recovery, particularly in the renovation market. At the same time, there have been reports from the market recently that a shortage of basic glass is looming. Is there any truth in these reports?

Matthias Rehberger / GW

Grönegräs: Yes, that's correct. The markets are beginning to recover – particularly in the renovation sector, which is of course encouraging. At the same time, we are currently experiencing a shortage of basic glass. If the markets pick up again, this trend is likely to intensify, as we are seeing an increasing shortage of glass availability.

GW News: What is the reason for this?

Grönegräs: After several years of declining markets, float glass manufacturers have cut back on production. As a result, some insulating glass manufacturers are also experiencing longer delivery times in order to obtain the necessary base glass in time. This in turn has an impact on their customers, the window manufacturers. The longer delivery times are therefore a direct symptom of this tense supply situation for base glass.

GW News: And how is it that, after years of declining market figures, the situation is now swinging to the other extreme?

Grönegräs: This is simply due to the limited number of float glass lines that are designed for fully continuous production. The output of such a line can only be adjusted to weaker market demand to a very limited extent.

That is why operators across Europe have shut down several lines in recent years, some of which have been converted to other products such as automotive glass, or have brought forward cold repairs to the plants that might otherwise have been necessary at a later date. When several producers do this and the entire production of entire plants is taken off the market at the same time, shortages can quickly arise when demand picks up again. It then takes time to counteract this. That is why we are now experiencing this phase of scarcity.

Interview conducted by Matthias Rehberger

And what is the situation on the window market?

After two difficult years, those responsible at the VFF are expecting a cautious turnaround for the domestic window and exterior door market after a difficult 2024: the window market shrank by 8.5% last year, and the exterior door market by 9.4%.

At the conference, it was predicted that the renovation market for windows is likely to grow significantly stronger than originally expected in 2025 – from 1.2% to 3.5% growth. New construction, on the other hand, remains a problem child: a further decline of 5.5% is expected here for 2025.

Matthias Rehberger